How do I identify and prioritise new audiences to work with?

A common issue for organisations is that, while wanting to diversify your audience and users, there is a lack of confidence in where to start which can sometimes halt any progress.

Also remember that we are considering potential – not everyone is going to be interested in archives. Around 3-5% of the UK population say they visit archives (according to the Department for Digital, Culture Media and Sport (DCMS) ‘Taking Part’ survey) and while as a sector we can aim to increase this, we’re not going to reach 100% of the population, so trying to engage with everyone is not going to be effective. You need a more focused approach to build meaningful relationships with people who haven’t engaged with your service before.

Once you have identified who is under-represented in your current user as a first action, a few points to help you prioritise further might be:

- are there potential themes in your collection content that might have a resonance with a particular group?

- what are the strategic priorities of your organisation or of your main stakeholder? Are there key issues you want to address, e.g. education, employment and skills, health and wellbeing, inequality?

- is there a gap in the market you could fill in your area, e.g. is there little provision for home schoolers or for refugee families?

- who are your partners, what are their priorities and plans over the coming years, could you work together to target a common audience?

- are there any easy (or more likely – easier) wins? Maybe this could be on your doorstep: your neighbours, or a partnership that can be re-invigorated?

- what opportunities or developments are on the horizon – is there a new plan for your area or a new funding stream or collaboration you could participate in?

- do you have specialisms within your team you could build on?

Figure 1 – prioritising new audiences

Absolutely vital in this mix is to consider your own resources – people, collections, building and spaces within it and your financial resource. Think about the resource required to engage with different groups, the likely outcomes and impacts you could achieve, and where you might best focus your efforts.

If you’re uncertain about prioritising new audiences, consider doing a short options analysis. Decide on your criteria and analyse the pros and cons of each of your new audiences against these criteria. What audience comes out top?

Build yourself a rationale for the audiences you want to engage with by considering each of these points and prioritising your longlist into a short one.

It’s important not to be overambitious and to be proportionate in your plans at this point. Developing new audiences takes time and effort to develop meaningful relationships that will build and be sustainable over years to come. It’s better to work with real impact with one or two new audience groups than to spread yourselves too thin.

Consultation methods

There are many methods you can use to consult with people. The most often used, almost as a default, is a questionnaire/survey or a comments/feedback form. While these certainly have their place, do consider different methods and choose the best one for your situation and needs.

It can be valuable to mix together more than one method, particularly to build a strong evidence case for change. It’s useful to combine quantitative data (i.e. numbers) with qualitative data (i.e. non-numerical information) to give a sense of scale combined with in-depth observation.

Below are a few consultation methods you could consider using. Some of these may be familiar to you and you may have already used some.

Surveys

These can be done in person with your team asking the questions or remotely by the respondent (e.g. online). Questions often have a list of possible responses to choose from plus some open response options.

Vox pops

Opinion-gathering on a topic using a semi-structured interview and small set list of questions. Often seen on television news reports along the lines of ‘what do you think about xxxx issue?’

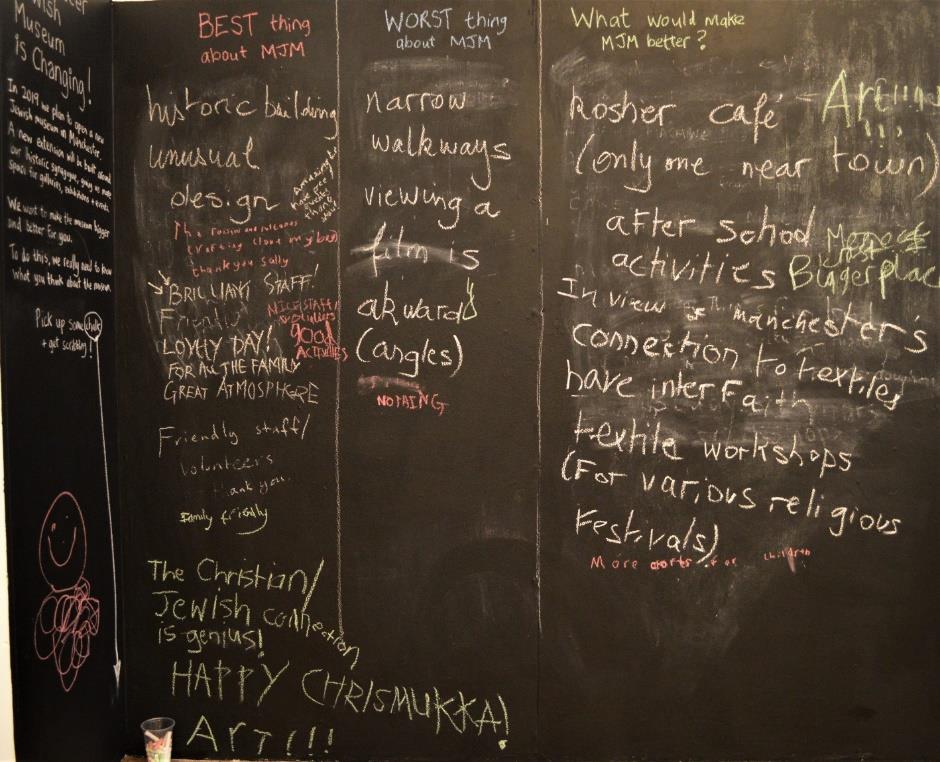

Feedback walls

A highly visible way to gather feedback with a set of posed questions that visitors are encouraged to answer anonymously.

Focus groups

A moderated small group discussion with a set of people with shared experiences or demographics to explore a set topic. Can be done in person or online.

1:1 depth interviews

An interviewer speaking directly to one person to explore a topic in depth – can be done in person or remotely.

Observational research

The process of watching and recording user/audience behaviour and interactions in your venue. Often used to understand use of space, dwell time, and engagement in different areas.

Advisory panels

Regular meetings with a group of people who are recruited to advise a service with an agreed objective over a set period of time. For example, a teacher advisory panel to support the development of a schools programme.

Journey mapping

A process which takes users through the actions they take when deciding to engage with and then visit your service. It involves visualising the journey into a timeline and identifying significant points along that line (often highs and lows) that can then be acted upon to improve the user experience.

Voting mechanisms

A tool devised to count user preferences and opinions. Can be low tech, for example marbles in a jar, ticks against a written list, or you can use technology such as ‘Mentimeter’ to enable remote access. This method can be used to gather a high volume of feedback for different options or ideas that are easy to explain, e.g. which of these exhibition ideas appeal to you most.

Creative feedback

Using methods to gather opinion and responses beyond the usual methods above. For example, asking visitors to draw a picture of their ideal archive space.

Postcode analysis

Collect postcodes to map the locations of your users, noting hot and cold spots. There are a number of models that analyse data from many different sources and then segment UK postcodes by common characteristics to provide an understanding of the different groups of people who make up your customer base and catchment area. This means you can collect customer postcodes and analyse them against different models to build up a profile of your users.

Mix it up

Not everyone likes to give written responses to questions, so surveys don’t work for everyone. Try out a focus group or an in-depth interview to gather verbal responses to your questions. Or encourage creative responses – how about asking someone to use collage to create a visual picture of their ideal events programme? Or to vote for the activities they’d most like to do by placing a marble in a jar, or a sticky dot on a flip chart list? Many of these methods can be low tech and low cost.

Figure 2 – creative feedback

Figure 3 – mixing methods – creative ideas, voting, plus survey

Figure 4 – voting for preferences at an external venue

Figure 5 – at a sports event to capture feedback on exhibition content

Whichever methods you use, make sure you record your findings. If you’re using a survey this might be built in to the software, but if not you need to have someone to take notes, do an audio recording, take photos and write up feedback.

Asking the right questions

The right questions are ones that:

- Provide insights into understanding your audience’s behaviours, motivations, attitudes, preferences and actions

- Will help you make decisions

Before you jump into writing a very long set of questions to use in a survey or an interview, stop and think back to your initial planning. What is the ‘big question’ you want to answer? It might be ‘how do we attract new people to visit us?’ or ‘why do we get no bookings from secondary schools?’

If this is your headline research topic, now break it down into sub-headings or research questions that will help you to answer this, e.g. ‘what stops people from visiting, have they heard of us, which parts of our service might they be interested in, how often might they visit, how can we get them to return after the first time?’

Some tips when writing questions for consultation and research:

- Plan a survey, interview or focus group as a flowing conversation. Start with easy factual questions that give context about your respondents (e.g. have they ever used an archive, which ones, what for) and then move onto deeper discussion.

- Where relevant, gather some contextual information about your respondents to help you interpret their answers, e.g. ask teachers what type of school and what subject(s) they teach, or ask for postcodes in surveys to understand if respondents are local or not.

- Use a mix of open and closed questions

- Try and give options to questions but make sure you leave space for other ideas with an ‘other’ option

- Try out using stimulus material in the same sort of way – show collection items, photos, stories to your group to give them a flavour of what you can offer before you ask them for ideas

- Mind your language – don’t use any acronyms or jargon and avoid terms that are sector-specific. To be sure, always test out questions on someone who doesn’t work in the sector as a sense-check.

- Test out online surveys to make sure the question and responses work properly, for example do you want multiple answers or just one to some questions.

If you have a comments book in your venue, what question(s) are you asking in there? Do you analyse the information given to you? Is it useful? Consider reviewing this, and think about changing the format so you’re able to change the questions to be more useful over time. For example, instead of asking ‘how was your visit’, how about asking ‘how could we improve your visit’ so the responses you receive are ones you could act upon.

The image below shows a large blackboard painted on to a wall to gather visitor feedback instead of a comments book. It was low cost, can be easily updated and changed, and is very visual to encourage take-up. It asks for people to consider their visit in terms of ‘the best thing’, the ‘worst thing’, and ‘what would improve it’. Staff regularly note down the responses, cluster them under common headings and report and discuss at team meetings.

Figure 6 – blackboard wall asking for ‘best/worst/improvements’ responses from visitors

Asking users if they are there for the first time can be really useful to know. If you have a low proportion of first-time users, you’re dealing with a fairly static user base and it should flag up the need to diversify for business reasons – we all need a source of new customers over time. Equally, a high number of first-time visitors can signal a service that attracts a lot of visitors passing through, often tourists, who may not return in person but who might be engaged online in the future. Or it might signify a retention problem.

Being consistent over time in the questions you ask is important if you want to add volume to your responses and/or compare trends over time. For instance, asking about future plans at a number of events over a period can help build up response numbers so you feel more confident about the results.

Recruitment

Recruiting people to take part in consultation can be hard work. Many people tell me they have tried surveys and had poor response rates or advertised a focus group and had no-one turn up. It takes some time and planning to do this well, as well as considering a few key points:

What’s in it for the participants?

You’re asking people to give up some time to help you with your work so make sure your starting point is thinking about how to incentivise them to do this. It might be food and drink or a shopping voucher, or the chance to enter a prize draw for an appealing prize. For people who are already interested in your service, it could be the chance for a guided tour of the stores, to see some items up close, or to attend a social event after hours.

Make it easy for them

The effort should be with you, not with your participants. If you want to speak to people who don’t attend your venue, go out and talk to them in the venues or areas they do attend (with the permission of the venue of course!). You could:

- Go to a family play centre if you want to speak to young families

- A youth group to talk to teenagers

- A community centre or library to get a broad mix of people in a particular location

- A local museum or heritage site to find other people interested in history

- Take a stall at a local community event with something interesting to entice people before you ask them for feedback

Consider timing

Again, think about a time to suit your participants if you’re planning an event like a group discussion. Don’t time it during working hours or across mealtimes. Teachers are most likely to attend something at the end of the school day before going home.

Plan ahead and make use of opportunities to recruit

If you’re meeting and networking, ask your contacts if they can help recruit to your consultation. If you organise any 1:1 in-depth interviews, do these first and ask the contact if they have a user group you could recruit to a focus group or circulate a survey to. You can also use a survey to add in a question to recruit people for other research, for example to a focus group.

Use your networks to promote your consultation

If you’re promoting a questionnaire to people who don’t visit your service, contact groups who work with the people you want to target and ask them to share a link with their users. Think about asking local history groups, family/parent networks, use social media (Facebook is full of local groups covering every possible interest area), youth leaders, teacher networks, and other heritage or cultural organisations who might share the link with their database in a newsletter. Make sure you include a deadline for completion if you’re sending out a survey, as it gives a sense of urgency, and ask people to share it with others too.

Make sure you thank people for their time and input and – if possible – let them know of any outcomes from the consultation, for instance that their ideas formed part of your plans for a funding bid, or for next year’s events programme. Build the relationship with them, invite them to an event, see if they want to go on your mailing list, and develop that positive connection so it might bear fruit in the future.

Exercise – mini consultation plan

By now you should be ready to put together a mini consultation plan. Take some time now and jot some notes down against the prompts below.

Who do you want to consult with?

Consider:

- Are they existing users or new ones?

- Shortlisting to focus on one or two audience groups (see figure one above)

What are your research questions?

Consider:

- Your over-arching research question

- The useful questions to help you develop your action plan

What methods are you going to use?

Consider:

- Mixing up quant and qualitative methods to give you both volume and depth of data

- Your timeframe and resource to deliver this

How will you recruit participants?

Consider:

- Where can you source participants, who can help with this, what networks do you know?

- How will you incentivise participation?

- Time and place

With your mini plan on paper, you’re going to need to think about what you do next with all of that data.