How to look for records of... Death duties 1796-1903

How can I view the records covered in this guide?

How many are online?

- Some

Contents

- 1. Why use this guide?

- 2. What are death duties?

- 3. Record types: indexes and registers

- 4. Information found in death duty indexes and registers

- 5. How to search for records

- 6. Understanding references in the registers

- 7. Understanding column headings and abbreviations in the registers

- 8. Other abbreviations used in the registers

- 9. Why can't I find an entry?

- 10. Other records

- 11. Records in other archives

- 12. Further reading

1. Why use this guide?

Use this guide for advice on how to find death duty records from 1796 (when several death duties were introduced) to 1903 (when the death duty registry system was replaced).

These records were originally created to record whether or not and how much death duty was paid on the estate of someone who died. Today they are a useful resource for family historians and other researchers as they can provide a wealth of useful information on the deceased, their friends and relations. Information can include:

- date of death

- information about the beneficiaries of the deceased’s will

- names of children of the deceased

For advice on finding a will, read our guides to looking for wills and administrations before 1858 and after 1858. The National Archives only holds wills proved by the Prerogative Court of Canterbury.

2. What are death duties?

Death duties were introduced in 1796 and are equivalent to what we would more commonly refer to today as inheritance tax. The term ‘death duties’ in this guide refers to three taxes:

- legacy duty

- succession duty

- estate duty

3. Record types: indexes and registers

Wills and administrations were processed by the probate courts which, before 1858 in England and Wales, were ecclesiastical courts found across the country, with multiple courts in each county. The probate courts sent a copy of each will and administration to the Inland Revenue where death duty was calculated. The Inland Revenue created registers to record all this incoming information from the courts. There were two main types of register: those for the Prerogative Court of Canterbury and those for all other courts, collectively known as the ‘country courts’. Larger courts might have had a number of registers for each year; smaller courts might have a single register covering more than one year.

There were separate sets of indexes created to help the clerks find entries in the registers at later dates. These indexes are still used today to help family historians and other researchers find the entry they are looking for. Between 1796 and 1811 each probate court was indexed separately.

The National Archives holds both the registers (in records series IR 26) and the indexes (in records series IR 27).

There are other record types and they are described in section 10.

4. Information found in death duty indexes and registers

The information in indexes and registers can include:

- the court in which a will was proved or an administration granted

- information about the beneficiaries of the deceased’s will (family relationships were often noted because close relations didn’t have to pay duties on their inheritance)

- the names, addresses and occupations of the executors

- what happened to someone’s personal estate (not freehold) after death

- what the estate was worth, excluding debts and expenses

- the name of the deceased, with address and last occupation

- the date (as well as the place) of probate

- details of estates, legacies, trustees, legatees and annuities

- the duty paid

Notes were sometimes made on the registers many years after the first entry. They recorded details such as:

- date of death of spouse

- date of death or marriage of beneficiaries

- births of posthumous children and grandchildren

- change of address

- references to law suits

- cross references to other entries

Before 1812 the registers include very brief abstracts of wills. From 1857 there are entries in death duty registers for all estates worth more than £20. However, those worth less than £1,500 didn’t have the taxes collected and not much was recorded about them.

5. How to search for records

Most searches for death duty records at The National Archives will be searches in the death duty indexes in series IR 27 and in the death duty registers in series IR 26, both described in section 3.

Death duty registers from country courts between 1796 and 1811 can be searched directly in our catalogue.

For other registers, you will first need to use the indexes on Findmypast.

5.1 Country court registers 1796-1811

You can search and download country court death duty registers 1796-1811 online, from The National Archives’ website. Not all of the country court registers survive.

5.2 Death duties indexes

To find an entry in the death duty registers you will first need to search the indexes (IR 27) to the registers online, see Step 1 below. The indexes provide you with the details you need to get to the right register.

Step 1: Search for an index entry

Go to findmypast.co.uk (£) and search for digitised images of the original indexes (from series IR 27) by the name of the person who died along with the year of death or the county where the person died, or both.

Step 2: Select the relevant person from search results

From your search results, identify the index entry for the person you’re searching for and click to view an image of the original index and a transcription (the transcription will be easier to read but you will need to view the image to determine whether the entry is for a will or an administration). You will need to pay to view the image and transcription unless you are at an archive or library with an institutional subscription to findmypast (viewing is free at The National Archives).

Step 3: Note the folio or entry number

The index entry and transcription should, between them, indicate whether it was a will or an administration, the court and year in which it was proved or granted and the corresponding folio or entry number in the register. From 1796 to 1811 there will be an ‘entry number’ and in later indexes a ‘folio number’. Note down this number. An index entry with no folio reference means that no tax was payable, in which case there will be no death duty record.

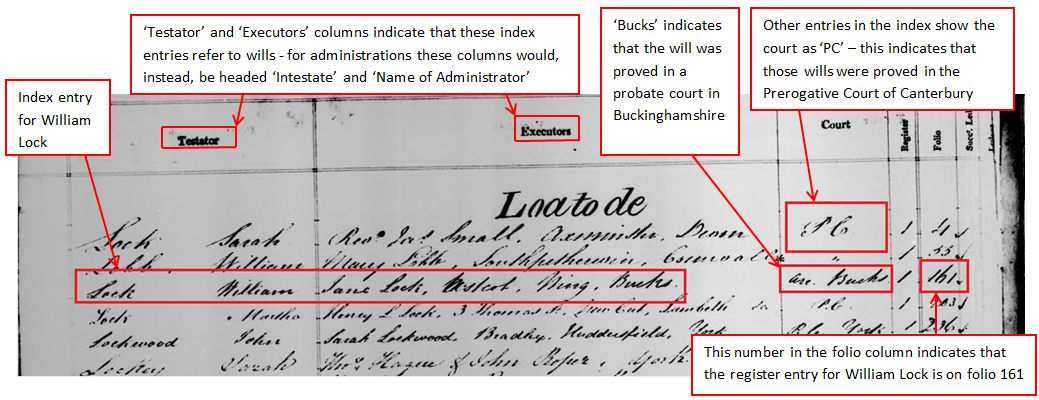

The example used in the image below shows the index entry for William Lock from 1826:

- The ‘Testator’ and ‘Executor’ columns indicate that this entry refers to a will rather than an administration (entries for administrations would not include these columns and there would, instead, be columns headed ‘Intestate’ and ‘Name of Administrator’).

- The column headed ‘Court’ indicates where the will was proved or the administration granted. For William Lock the ‘Court’ column entry shows his will was proved in a court in Buckinghamshire. Other entries in this section of the index are listed as ‘PC’ in this column – this indicates that those wills were proved in the Prerogative Court of Canterbury.

- The ‘Folio’ column indicates the folio in the register for the respective index entry. William Lock’s entry shows that the details of the death duties payable on his estate are shown on folio 161 of the register.

Death duty index entries (IR 27) for wills from 1826, including that of William Lock.

5.3 Death duty registers (country courts and PCC) 1796-1903

Go to IR 26 in our online catalogue – this is the series reference for the registers. Use the search box to search either with the word ‘will’ or ‘administration’ (depending on the type of index entry you found) and in both the date range boxes enter the year that the will or administration was proved or granted. Click ‘Search’.

Step 1: Reorder the references

Your search results will be presented to you in ‘Relevance’ order. Change them to display in ‘Reference’ order. This will make it easier to scroll through to the right range of folio numbers.

The dropdown menu displayed above search results allows you to sort your results by ‘Reference’ instead of the default ‘Relevance’.

Step 2: Find the document reference for the folio number

Each document reference covers a range of folio (or entry) numbers in the respective register. With your search results in ‘Reference’ order, scroll to the range which covers the folio (entry) number you noted at Step 3. Note the document reference (in our example, the reference is IR 26/1092).

Step 3: Look through the register

You will need to visit us to see the registers. Once you have found the correct reference for the IR 26 register you located at Step 2, look through the pages to find the folio number you noted down from the indexes in IR 27 (see section 5.2). Folio numbers appear in the top corner of a double-paged spread, usually on the left.

First few columns of the register entry for William Lock (IR 26/1092).

If you cannot locate an entry, see section 9 for a list of possible explanations. Alternative sources include the specimen death duty accounts in records series IR 19 – see section 10 for more alternatives.

5.4 Death duty registers (country courts and PCC) 1796-1857

Digital images of death duty registers can be found on the FamilySearch website. They can only be viewed at The National Archives, FamilySearch Centers or other affiliate libraries using the links below. Registers are listed with alphabetical ranges, folio numbers and year, images are viewed by clicking on the camera icon on the right.

- Death duty register for wills in the Prerogative Court of Canterbury, 1796-1811; and administrations, 1796-1857 and indexes.

- Death duty register for wills in the Prerogative Court of Canterbury and country courts, 1812-1857

- Death duty register for abstracts of administrations in the country courts, 1812-1857

6. Understanding references in the registers

Some entries in the registers may lead to other registers or records:

- References like RR/41/J/12 refer to ‘reversionary registers’, which may be worth examining if the estate you are researching had any of its parts left in trust before 1852. You can browse these descriptions in our catalogue; there are only 11 files. Click on ‘details’ to see the folio range that each covers.

- A reference like RA 767/46 1 LD refers to ‘residuary accounts’ (in this example 767 refers to the folio number and 46 refers to the year 1846). Most of these have been destroyed, although a few survive in IR 19. To find them, use the IR 19 series search to search with the keyword ‘will’ or ‘administration’ and the relevant year. There are some residuary accounts relating to well-known people in IR 59. To find them, use the IR 59 series search.

- A reference like SA 85/120 refers to succession duty registers. To find them, use the IR 26 series search. Enter the phrase ‘succession registers’ and the relevant year. Find the file for the right letter and folio range.

- A reference like Lr 234/16 (number 234 letter for the year 1816) refers to in-letters to the Legacy Duty Office and copies of out-letters in IR 6 which survive for the years 1812 to 1836 only. You can search by year within IR 6 and find the document reference with the relevant range of letter numbers (please note IR 6 documents are stored offsite and take three working days to produce).

7. Understanding column headings and abbreviations in the registers

The table below, based on a register from 1837, explains what the less intuitive column headings in the registers mean, and the information you can expect to find under them. Though the format of the registers changed over time these should cover most column headings that you are likely to come across. There are subsets of column headings which appear within broader overarching headings – the table below covers both types.

| Column heading in the register | Meaning | Abbreviations used in this column |

|---|---|---|

| Residence | Residence of executors | |

| Description | Occupation/rank of executors | |

| Where and when proved | Court and date at which the will was proved | ArchCt/Totnes/archd’on = Archdeaconry court of Totnes BishCt/Lichfield / = Bishop’s (consistory) court of Lichfield ConCt/London = Consistory court of London ConstEpic/Wells = Episcopal Consistory Court of Bath & Wells Deans/Lichfield = Dean and Chapter of Lichfield Ecclesi/St Albans = Archdeaconry of St Albans ExCt/York = Exchequer court of the Archbishop of York PC/Cant.y = Prerogative court of Canterbury PecuC/Biggleswade = Peculiar court of Biggleswade RuralD/Chester = Rural Dean of Chester |

| Sum sworn under | Approximate value of the total estate | |

| Legacies | Description of size and types of items bequeathed in the will | annych’d on R and P Est = annuity charged on real and personal estate chgd = charged 3 P C Cons = 3% Consols 3 P C Red = 3% Reduced bank annuities |

| Observations | Notes on the legacies or other information for the purposes of estimating duty payable | |

| To whom in trust | To whom estate is entrusted, that is the executors | exors = executors |

| For what purpose | What is to be done with the legacy; into how many portions it is to be divided; upon what conditions legatees are entitled to it; whether the legacies have to be converted into certain forms for payment, etc. |

|

| Legatee | To whom the legacies are due | Resy Legatee = residuary legatee (that is the legatee who receives the remainder of the estate once the claims of the other legatees have been satisfied) |

| Consanguinity | Relationship of the legatee to the deceased for the purposes of calculating the rate of duty payable on the legacy | For abbreviations see separate table in section 8.2 |

| Upon what contingency or, if in succession, of equal rate | Upon what conditions the legacies are bequeathed and procedures to be followed when the legatee dies – that is, whether the legacy pass to the legatee’s heirs or to other defined persons | For abbreviations see separate table in section 8.3 |

| What deemed | The form of the bequest; whether an absolute gift or an annuity and whether there are any contingency clauses to the bequest | abs = absolute legacy (that is no strings attached) abs & int = absolute and interest abswp = absolute legacy with a proviso (conditional grant) anny = annuity anny wp = annuity with a proviso (conditional annuity) dwp = ditto (usually absolute) with a proviso in deft of appt eqy amg them = in default of apportionment equally among them |

| Age of annuitant* | Age of the annuitant; given in some cases only | |

| Value of annuities and bequests* | Value of actual bequests received by legatees or total value of annuities as computed for paying duty | |

| Rate of duty* | Percentage of bequest or annuity to be paid as duty according to degree of consanguinity | |

| Date of payment* | Date when payments of duty took place | |

| Annuity installments* | Value of installments of duty paid on annuities – there were usually four such payments | |

| Total duty* | Total duty paid on legacy |

*These columns sometimes contain no information, presumably because duty was never paid or because there were insufficient assets to pay for legacies. In place of such information is often a reference such as ‘RA 767/46 1 LD’ which refers to ‘residuary accounts’. These have been destroyed, although a few still survive in IR 19 and IR 59.

8. Other abbreviations used in the registers

8.1 Abbreviations found in various columns of the death duty registers

| Abbreviation | Meaning |

|---|---|

| de bonis non /15th Oct 1851/ | date of later grant of administration |

| in resd | in residue |

| not liable | the bequests are to relatives too closely related to the deceased for duty to be payable |

| not subject to Duty | legacies are to be paid out of the profits of land charged on real estate sales and are therefore (pre-1805) not liable to duty |

| P E | personal estate |

| qy | query |

| R A /1448-1837/ | Residuary Account, Number /1448-1837/ – reference to accounts of money received as duty. Most of these accounts have now been destroyed, although a few remain in IR 19 and IR 59. |

| R E | real estate |

8.2 Abbreviations used to describe relationships (under ‘consanguinity’ in the register)

| Abbreviation | Meaning |

|---|---|

| BF | brother of a father (uncle) |

| BM | brother of a mother (uncle) |

| Child or Ch | child of deceased |

| DB | descendant of a brother (niece, nephew and so on) |

| DS | descendant of a sister (niece, nephew and so on) |

| DBF | descendant of a brother of a father (that is, cousin) |

| DBM | descendant of a brother of a mother (that is, cousin) |

| DSF | descendant of a sister of a father (that is, cousin) |

| DSM | descendant of a sister of a mother (that is, cousin) |

| DBGF | descendant of a brother of a grandfather |

| DBGM | descendant of a brother of a grandmother |

| DSGF | descendant of a sister of a grandfather |

| DSGM | descendant of a sister of a grandmother |

| G child | grandchild |

| GG child | great-grandchild |

| G daughter | grand-daughter |

| G son | grand-son |

| SF | sister of a father (that is, aunt) |

| SM | sister of a mother (that is, aunt) |

| Str or Stra or Strag | stranger in blood |

| Stra BL | stranger, brother-in-law |

| Stra DL | stranger, daughter-in-law |

| Stra NC | stranger, natural child (that is, illegitimate) |

| Stra ND | stranger, natural daughter (that is, illegitimate) |

| Stra NS | stranger, natural son (that is, illegitimate) |

| Stra NC (of a daughter) | stranger, illegitimate child of a daughter |

| Stra NC (of a son) | stranger, illegitimate child of a son |

| Stra (sent) | stranger, servant of deceased |

| Stra SL | stranger, sister-in-law or stranger, son-in-law |

| Stra or ‘son’ | stranger, natural son (that is, illegitimate) |

| Stra or ‘daughter’ | stranger, natural daughter (that is, illegitimate) |

8.3 Abbreviations used in the ‘contingency’ column

| Abbreviation | Meaning |

|---|---|

| amg | among |

| attn | attains |

| contingency | conditions of bequest |

| dividds | dividends |

| eqy | equally |

| est | estate |

| int | interest |

| int durg miny prinl when 21 | interest on bequest payable during minority of legatee and principal when legatee attains 21 years of age |

| pble | payable |

| p or princl | principal |

| reversion | bequest reverts to another legatee upon a certain condition, for example the death of the first beneficiary |

| ring etc. | mourning ring and other bequests |

| SER or suc of equal rate | succession of equal rate after death of legatee, that is equal division of the bequest amongst the heirs of the legatee |

| until she attns 21 or marr | legacy not operable until the beneficiary reaches the age of 21 or marries |

| when 21 with accumls | legatee to receive principal and accumulated interest on it when he reaches the age of 21 years |

| with bent of survp | with benefit of survivorship, that is if a bequest is distributed between a group of legatees and one dies, the rest are entitled to share out that legacy equally amongst themselves within six months = payment of legacy within this period |

9. Why can’t I find an entry?

There are a number of reasons why you might not find a death duty entry:

- Many of the registers for the 1890s were destroyed by fire.

- Less valuable estates were often exempt from death duty. From 1858 there should be a record for all estates worth more than £20, but not from before that date.

- From 1796 bequests to children, spouses, parents and grandparents were not taxable. In 1805 this exemption was reduced to spouse and parents, and from 1815 only bequests to the spouse were exempt.

- From 1903 onwards only selected files survive; they are in record series IR 59 and all relate to well-known people.

- Death duties were not paid on a person’s estate if they died as a result of wounds or disease during active service in the armed forces.

- The starting date of a small number of country court registers is between 1800 and 1805, and not 1796.

Read the IR 26 series description in our catalogue for information on the history and arrangement of death duty registers.

10. Other records

The following record series also relate to death duties – click on the references to search within the respective series:

- IR 19 – specimen death duty accounts

- IR 59 – death duty accounts for well-known people; some of these records are closed to the public. Where this is the case the catalogue description will explain how to request access to the record under the Freedom of Information Act 2001

- IR 6 – correspondence on contentious cases

- IR 7 – correspondence on contentious cases for Scotland

- IR 49 and IR 50 – contentious cases reported to the Treasury

- IR 67 – legacy, succession and probate duty case books

- IR 62 – precedent files. Files with piece numbers 1-1050 are not kept at Kew and will need to be ordered three days before you plan to visit

- IR 98/1-9, IR 98/30-31 – death duties cases

- IR 99 – solicitors’ opinions and reports relating to death duties cases. Files with piece numbered 1-170 are not kept at Kew and will need to be ordered three days before you plan to visit

- E 188 – miscellaneous petitions relating to appeals against Inland Revenue assessments for estate or succession duty

11. Records in other archives

Copies of wills from the major local probate courts in Cornwall, Devon and Somerset were sent to the respective local archives. See the Somerset Heritage Centre website for more information about the wills they hold.

You can also search our catalogue for records held elsewhere. Refine your results using the filters.

12. Further reading

Use our library catalogue to find a recommended book list.

The books are all available in The National Archives’ reference library. You may also be able to find them in a local library. You can buy from a wide range of history titles in our bookshop.